Looking for the best finance books? Make sure to check out “The Intelligent Investor” by Benjamin Graham and “Rich Dad Poor Dad” by Robert Kiyosaki for valuable insights and financial wisdom.

These books provide practical advice and strategies for managing personal finances and investing wisely. If you’re eager to enhance your financial literacy and make informed decisions about money, learning from the experiences of successful investors and financial experts can be immensely beneficial.

These recommended finance books delve into essential concepts like value investing, wealth building, and mindset shifts towards wealth creation. By exploring the principles shared in these books, you can gain valuable knowledge that will empower you to take control of your financial future and achieve your monetary goals. Whether you’re a beginner or a seasoned investor, these books offer timeless wisdom and actionable strategies for financial success.

Credit: www.target.com

Table of Contents

1. Unlocking The Potential Of Finance Books

Embracing the potential of finance books opens a world of knowledge, insight, and practical wisdom. These invaluable resources offer an opportunity to learn from the experts, gain insights into investing, and master personal finance. Let’s delve into the wealth of knowledge waiting to be unlocked within the pages of top finance books.

1.1 Learning From The Experts

Engaging with finance books allows you to tap into the wealth of knowledge shared by renowned financial experts. Authors such as Warren Buffett, Suze Orman, and Robert Kiyosaki offer their experience and expertise, providing readers with proven strategies and insightful perspectives on navigating the complex world of finance.

1.2 Gaining Insights Into Investing

Finance books provide a gateway to understanding the intricacies of investing. Through real-life examples and practical advice, these resources empower readers to make informed investment decisions, manage risks, and identify lucrative opportunities in various financial markets.

1.3 Mastering Personal Finance

These books offer practical guidance on managing personal finance, from budgeting and saving to debt management and retirement planning. Readers can explore strategies for achieving financial freedom and building a secure future through websites and case studies.

Credit: pamelaslim.com

2. The Top Finance Books You Should Read

If you’re looking to gain valuable insights into managing your finances, these top finance books offer a wealth of knowledge and practical advice. Whether you’re seeking to build wealth, invest wisely, or change your mindset about money, these books provide valuable lessons from experienced financial experts.

2.1 ‘Rich Dad, Poor Dad’ by Robert Kiyosaki

Robert Kiyosaki’s ‘Rich Dad, Poor Dad’ emphasizes the importance of financial education and challenges traditional beliefs about money. With engaging anecdotes and practical wisdom, this book offers a fresh perspective on wealth-building and financial independence.

2.2 ‘The Intelligent Investor’ by Benjamin Graham

Benjamin Graham’s ‘The Intelligent Investor’ has been hailed as a timeless classic in the world of investing. This book provides valuable insights into the principles of value investing and offers a solid foundation for making sound investment decisions.

2.3 ‘Think and Grow Rich’ by Napoleon Hill

Napoleon Hill’s ‘Think and Grow Rich’ delves into the mindset and psychology of success, offering a roadmap to achieving financial prosperity. With a focus on the power of positive thinking and goal setting, this book provides practical strategies for attaining wealth and success.

2.4 ‘The Millionaire Next Door’ by Thomas J. Stanley

Thomas J. Stanley’s ‘The Millionaire Next Door’ sheds light on the habits and lifestyles of everyday millionaires, debunking common myths about wealth. This insightful book highlights the importance of frugality, discipline, and smart financial choices in building lasting wealth.

2.5 ‘A Random Walk Down Wall Street’ by Burton Malkiel

Burton Malkiel’s ‘A Random Walk Down Wall Street’ offers a comprehensive guide to understanding the principles of investing. With a focus on the efficiency of financial markets and the concept of random walks, this book provides valuable insights into building a successful investment strategy.

3. How Finance Books Can Improve Your Wealth

Get ahead in building your wealth by diving into the world of finance with these top-notch books. Learn valuable insights and strategies to improve your financial situation and make informed decisions for a prosperous future.

3.1 Understanding Money Management

One of the key aspects of building wealth is understanding how to effectively manage your money. Finance books provide valuable insights into budgeting, saving, and spending wisely. They offer practical tips and strategies to help you take control of your finances and make informed decisions. By improving your money management skills, you can maximize your income, minimize expenses, and ultimately increase your wealth.

3.2 Developing A Long-term Investing Strategy

Investing is a crucial component of wealth-building, and finance books play a vital role in helping you develop a long-term investing strategy. They provide guidance on various investment options, such as stocks, bonds, real estate, and mutual funds, helping you make informed decisions based on your financial goals and risk tolerance. By understanding the principles of investing, you can grow your wealth over time and make your money work for you.

3.3 Expanding Your Financial Knowledge

Expanding your financial knowledge is essential for improving your wealth. Finance books offer a wealth of information on topics like personal finance, economics, and financial markets. They provide insights into complex concepts in a simplified manner and equip you with the knowledge necessary to navigate the world of finance. By continuously expanding your financial knowledge, you can stay updated with the latest trends and make well-informed financial decisions.

3.4 Accumulating Assets And Building Wealth

Accumulating assets is a crucial step towards building wealth, and finance books can guide you in this process. They offer insights into various asset classes, such as real estate, stocks, and businesses, and provide strategies to acquire and grow these assets. By understanding how to accumulate assets strategically, you can increase your net worth and create a solid foundation for long-term financial success.

3.5 Cultivating A Mindset For Financial Success

Cultivating a mindset for financial success is just as important as acquiring financial knowledge and implementing strategies. Finance books emphasize the significance of developing a positive and disciplined mindset towards money. They provide motivational stories, mindset exercises, and practical tips to help you overcome financial challenges and develop a mindset focused on abundance, wealth creation, and long-term financial success.

4. Tips For Getting The Most Out Of Finance Books

Reading finance books is an excellent way to expand your knowledge and improve your financial literacy. However, to truly maximize the benefits of these books, it is essential to approach them with a focused mindset and actively engage with the material. In this section, we will explore five tips that will help you get the most out of your finance books.

4.1 Setting Clear Objectives

Before diving into a finance book, it is crucial to set clear objectives for what you want to achieve from your reading. Are you looking to gain a basic understanding of finance concepts or dive deeper into specific areas? By setting clear objectives, you can focus your reading and ensure that you are selecting books that align with your goals. Writing down your objectives can also serve as a reminder of what you hope to achieve as you progress through the book.

4.2 Actively Engaging With The Material

Simply reading through a finance book passively won’t help you fully grasp the concepts discussed. To get the most out of the material, you need to actively engage with it. This means questioning the concepts, pausing to reflect on how they apply to your own financial situation, and connecting the dots between different ideas. Actively engaging with the material helps to deepen your understanding and makes the information more actionable.

4.3 Taking Notes And Applying Concepts

One effective way to reinforce your learning is to take notes while reading finance books. Whether it’s summarizing key points, highlighting important concepts, or jotting down your own thoughts and ideas, note-taking helps to actively process the information. Additionally, don’t just limit yourself to reading the book; actively apply the concepts to your own financial life. This practical application will solidify your understanding and help you implement positive changes.

4.4 Seeking Additional Resources

While finance books provide a wealth of knowledge, they are not the only resource available to you. To expand your understanding, consider seeking out additional resources such as online articles, podcasts, or videos. These supplementary materials can provide different perspectives, real-life examples, and further insights into the topics covered in the books. By diversifying your sources of information, you can enrich your learning experience and gain a more comprehensive understanding of finance.

4.5 Joining Finance Book Clubs Or Discussion Groups

Learning is often enhanced when done in a community. Consider joining finance book clubs or discussion groups where you can engage in conversations with like-minded individuals. These groups offer an opportunity to share insights, exchange ideas, and gain different perspectives on finance books and concepts. Being part of a community can also help to keep you motivated, accountable, and provide a platform to ask questions or seek clarification on any challenging topics.

5. Exploring Niche Finance Books And Topics

Welcome to the fifth part of our exploration into niche finance books and topics. In this section, we will delve into specialized books that cater to specific audiences and tackle unique aspects of finance. Whether you are an entrepreneur, a millennial, or someone looking for hidden gems in finance literature, we have got you covered. Let’s dive in and discover some fascinating books that will expand your financial knowledge.

5.1 Specialized Books For Entrepreneurs

Entrepreneurs face a unique set of financial challenges, and there are several books that can provide valuable insights. One such book is “The Lean Startup” by Eric Ries, which focuses on the financial aspects of building a startup and emphasizes the importance of customer feedback in driving financial success. Another must-read is “The E-Myth Revisited” by Michael E. Gerber, which explores how entrepreneurs can avoid common financial pitfalls and build a scalable business.

5.2 Books On Behavioral Finance

Behavioral finance examines how psychology influences financial decisions. Understanding the psychology behind financial choices can help you make better investment decisions and manage your money more effectively. One highly acclaimed book in this field is “Thinking, Fast and Slow” by Daniel Kahneman. This book delves into the cognitive biases that affect our financial choices and provides valuable insights into how we can make smarter decisions.

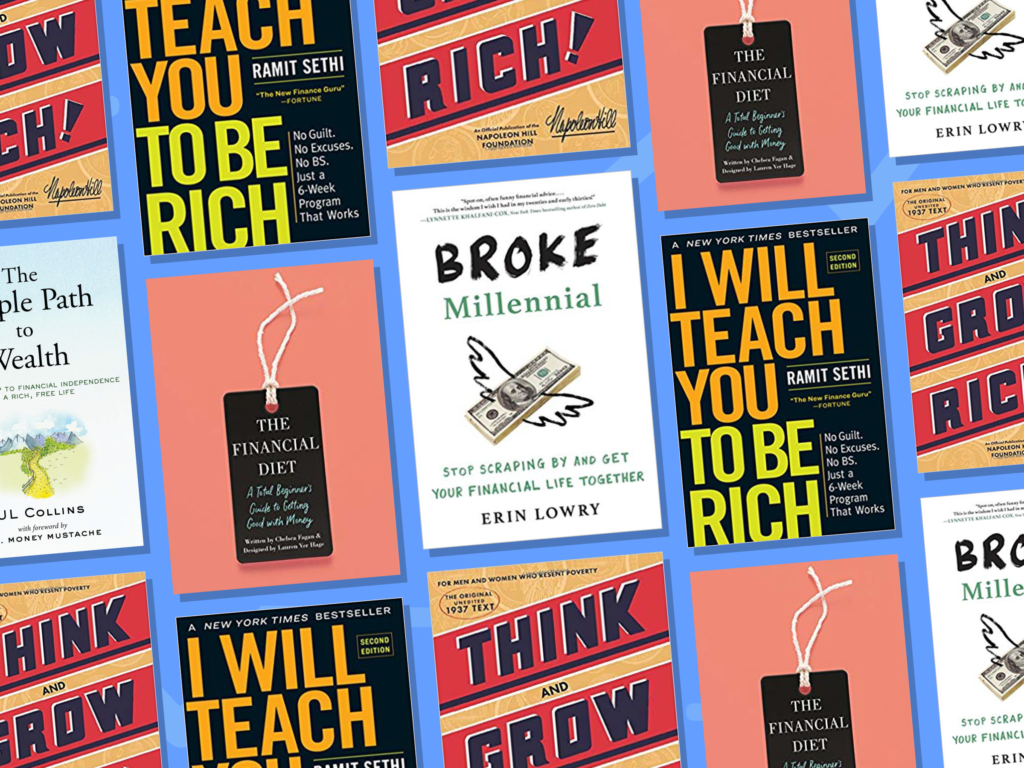

5.3 Finance Books For Millennials

Millennials have unique financial challenges, from student loan debt to navigating a changing job market. Fortunately, there are books that specifically address their concerns. “Broke Millennial” by Erin Lowry is a fantastic resource that offers practical advice on tackling debt, managing expenses, and building financial security. Another book worth mentioning is “Millennial Money Makeover” by Conor Richardson, which provides a step-by-step guide on achieving financial success in the digital age.

5.4 Books On Financial Independence And Early Retirement

Many individuals aspire to achieve financial independence and retire early. To help you on this journey, there are books that focus specifically on this topic. “The Simple Path to Wealth” by JL Collins offers a straightforward approach to achieving financial independence through low-cost index investing. Another popular choice is “Financial Freedom” by Grant Sabatier, which provides a roadmap for achieving financial independence and retiring early, even if you are starting from scratch.

5.5 Hidden Gems In Finance Literature

If you have exhausted the well-known finance books, it’s time to explore some hidden gems. These lesser-known books offer fresh perspectives and valuable advice. One such gem is “The Four Pillars of Investing” by William J. Bernstein, which provides a comprehensive overview of investment strategies and offers practical guidance for building a successful portfolio. Another hidden gem is “The Behavior Gap” by Carl Richards, which uses simple illustrations to highlight common behavioral mistakes that investors make.

Credit: www.amazon.com

Frequently Asked Questions Of Best Finance Books

Question 1: What Are The Best Finance Books For Beginners?

Some of the best finance books for beginners include “Rich Dad Poor Dad” by Robert Kiyosaki, “The Intelligent Investor” by Benjamin Graham, and “Think and Grow Rich” by Napoleon Hill. These books provide essential financial knowledge and insights for those starting their journey in finance.

Question 2: What Finance Books Are Recommended For Entrepreneurs?

As an entrepreneur, you can benefit from reading books like “The Lean Startup” by Eric Ries, “Zero to One” by Peter Thiel, and “The E-Myth Revisited” by Michael E. Gerber. These books offer valuable advice on starting and scaling a business, managing finances, and understanding market dynamics.

Question 3: Are There Any Finance Books Specifically For Women?

Yes, there are finance books specifically targeted towards women. Some noteworthy options include “Smart Women Finish Rich” by David Bach, “The Money Book for the Young, Fabulous & Broke” by Suze Orman, and “Rich Woman” by Kim Kiyosaki. These books address the unique financial challenges and opportunities that women may face.

Question 4: Which Finance Books Focus On Investing?

Several finance books focus on investing, such as “The Little Book of Common Sense Investing” by John C. Bogle, “A Random Walk Down Wall Street” by Burton Malkiel, and “The Four Pillars of Investing” by William J. Bernstein. These books delve into investment strategies, principles, and techniques for achieving long-term financial success.

Conclusion

These finance books offer valuable insights and knowledge for individuals looking to improve their understanding of personal finance and investment strategies. By providing practical advice and real-life examples, these books empower readers to make informed financial decisions and achieve their financial goals.

Whether you are a beginner or an experienced investor, these books are a must-read to enhance your financial literacy and take control of your financial future. Grab a copy of these best finance books and embark on your journey towards financial success today.